Hi Theater is Hard Readers & Subscribers,

As you might know, there was a Town Hall at Playwrights Horizons on June 30th, 2025 to address their egregiously man-heavy 2025/2026 season.

On July 1st, I posted my immediate response to what I saw as a solution-free Town Hall, called The New Democratic Artistic Regime of New York City. It was a rough outline of a paid subscriber-based New York City theater remodel that myself and my artistic-life partner Reid dreamt up.

The below is the mission statement, business plan, budget and aesthetic production guidelines for Theater No More.

Theater No More is not a theater company, rather a theater system so we don’t have to have any more town halls reminding people in power to program the right way. Because by using the Theater No More system, there are no more people in power. You lost your chance, boys.

We were going to wait until we had a few more friends read this over before posting, but I think in the spirit of democracy and in opposition to the horror that is July 4th in Trump’s new fascist state, we decided to look to you, Theater Is Hard reader, for constructive feedback. It would be awesome if you could offer “yes, and” rather than “no, because” to our plan. Also, this is an international system, not just NYC-based.

The Theater No More system has been conceived and written by myself and Reid Farrington.

Enjoy.

THEATER NO MORE: Mission Statement.

Theater No More is a democratic, subscription-based theater producing system. It is designed to reject single-person artistic leadership. This system is not a shortcut to gender, racial or disability parity, nor is it an exercise in empty diversity pledges, enforced quotas or performative tokenization from institutions. These are the very failed attempts at inclusion that have allowed institutional power to remain concentrated while offering only symbolic gestures of equity. Theater No More is egalitarian in its play selection through majority rules elections, budget transparency and full accountability. All participants in Theater No More must be subscribing members.

The following plan is the first iteration and proof of concept. It is a beta test. If the model holds, the goal will be to develop an ongoing, multi-year, multi-production entity led by subscribers only.

Theater No More is not a theater company; it is a dogma, a system to be applied to any theater anywhere in the world. The Theater No More system is designed to be stolen, copied, applied and weaponized.

Theater is dead, long live Theater No More.

THEATER NO MORE: Stages of Beta Test - Subject to review and revision based on legal, financial, and operational considerations.

1. Launch the Website & Open Subscriptions

We will launch the Theater No More website and open subscriptions to members. Subscriptions grant members access to participate in the beta process.

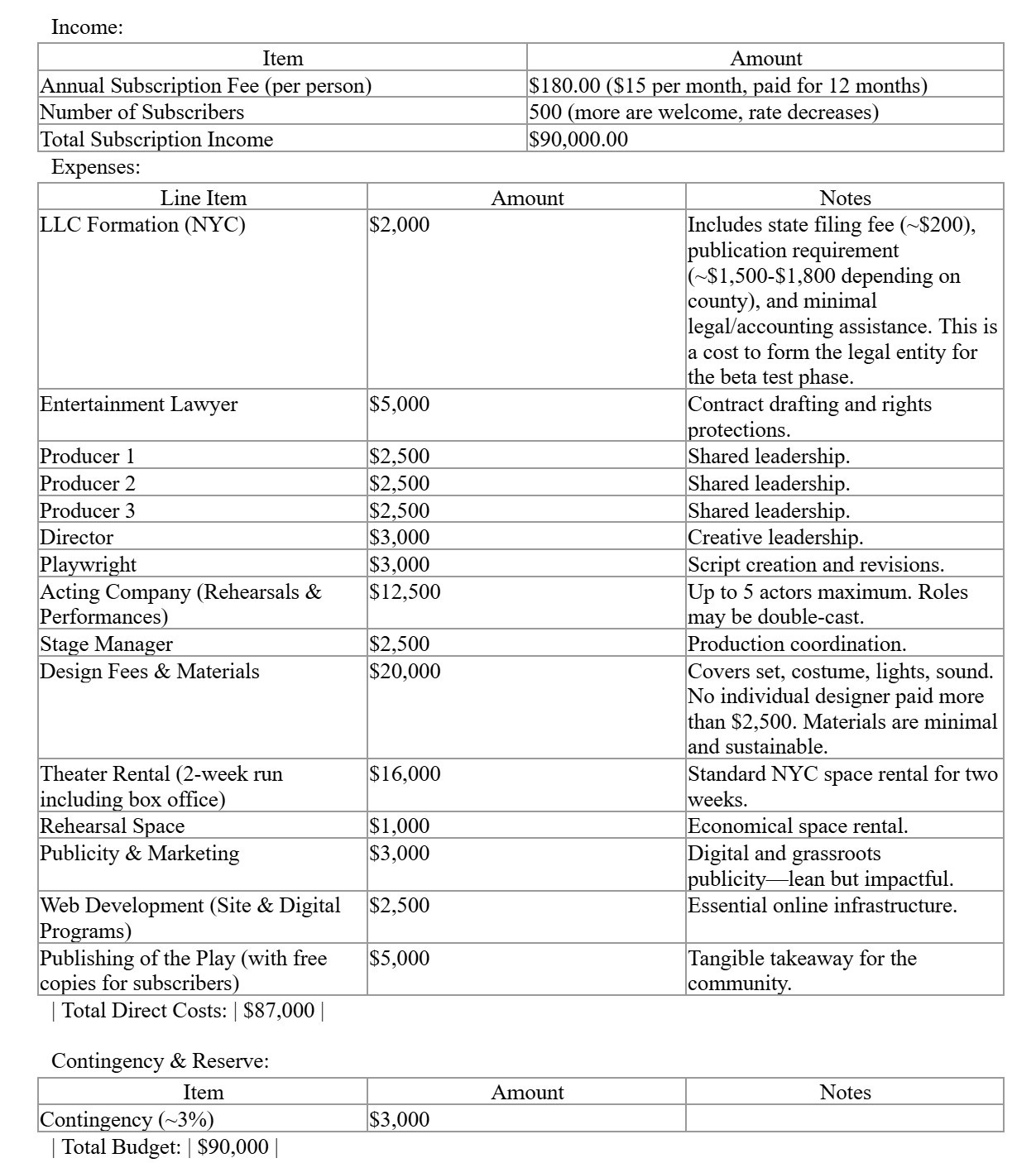

Each subscriber pays $180 USD which is $15.00 per month, paid for the full 12 months at once.

All subscription fees are non-refundable, except where required by law.

If 500 subscribers are not met within 3 months, all monies are returned.

2. Reach 500 Subscribers & Open Play Submissions

Upon reaching 500 active subscribers, we will open the call for play submissions for a three-month window. Subscriptions remain open after 500 for the duration of the beta test phase and if additional subscriptions are secured, the overall cost to each subscriber will reduce, with initial subscribers receiving a proportional refund.

All play submissions must include signed agreements outlining rights, royalties and permissions.

Submission does not guarantee production. Election majority does.

In order to ensure productions remain financially feasible within the available subscriber-funded budget, Theater No More has released a set of Dogme 95-inspired production guidelines. These rules will set creative and practical limitations on submitted plays to control costs without compromising artistic integrity. These include caps on cast size, technical complexity, scenic demands and other production elements.

3. Vote on the Play

Three months after submissions open, members in good standing will vote on the play they wish to see produced.

Each member receives one anonymous, non-changeable vote.

Full voting results will be made public in process on the Theater No More website.

Voting records will be retained securely for transparency and dispute resolution.

Theater No More reserves the right to disqualify submissions or intervene in cases of fraud, ineligibility or logistical challenges.

4. Produce the Play

The selected play will move into development and production.

The forthcoming production guidelines will apply to ensure the project remains within the beta production budget.

Theater No More retains the discretion to cancel or substitute a production in the event of legal, ethical or logistical concerns.

5. Open the Production

Approximately six months after voting, the production will premiere for a two-week run.

Each active subscriber receives one complimentary, non-transferable ticket.

Additional tickets will be sold to the public at fair market rates.

There will be a no comps policy across the board, including for press, critics, friends, and family.

We will honor Actors’ Equity Association and other relevant union comp policies as necessary out of respect to the unions.

6. Close the Production

After the scheduled run, the production will officially close.

There is no obligation to extend, tour or remount the production beyond the initial beta phase.

7. Publish the Play

The produced play will be published and made available to wider audiences via Theater No More’s forthcoming publication imprint.

All publication and future licensing rights will be governed by separate agreements with the playwright.

8. Financial Transparency

At the conclusion of the production:

Theater No More will release a financial summary outlining total income, expenses, and net profit (if any) to the subscriber base.

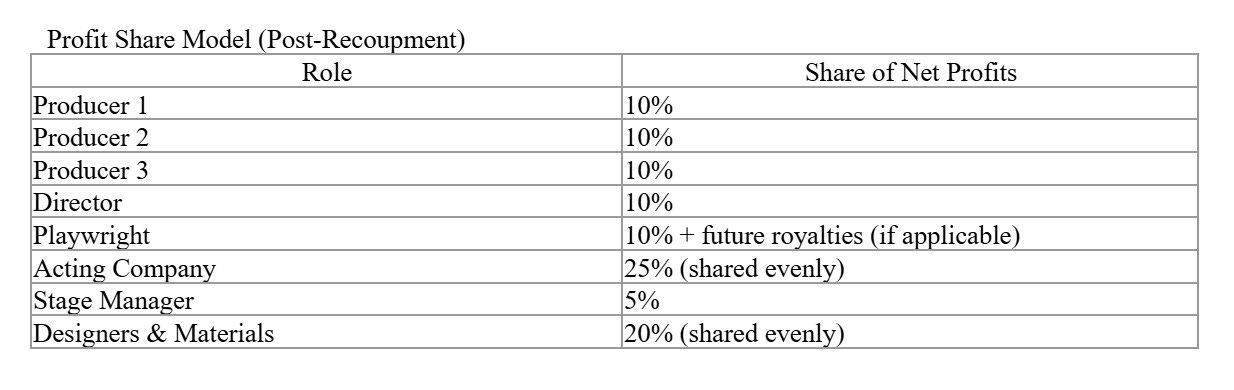

Once all production expenses are recouped (initially estimated at $90,000) and returned to the subscribers, any net profits will be distributed according to the following Profit Share Model:

Additional Guidelines:

Recoupment First: No profit distribution until all production costs are fully recouped.

Equity Caps: No individual participant may receive more than 10% of profits unless expressly agreed in writing.

Playwright’s Rights: Any future licensing or publication profits beyond the initial production will include standard playwright royalties, separate from this profit pool.

Financial Disclosure: While we will publish clear, understandable summaries of all income, expenses, and distributions, full financial statements may be withheld due to legal or privacy constraints.

THEATER NO MORE: Working Budget (Beta test phase budget transparency for a sustainable model)

THEATER NO MORE: What Makes This Possible

Legal and financial legitimacy for Theater No More from day one.

Clear artist compensation within a bare bones but achievable framework.

Transparent cost control that reflects real NYC pricing.

THEATER NO MORE: Production Guidelines - Version 1.0 for beta test phase, subject to review and revision.

To ensure that every production remains financially viable within the subscriber-supported budget, Theater No More adopts the following Aesthetic Guidelines, inspired by the spirit of the Dogme 95 film movement. These rules are designed to strip away excess, level the playing field and ignite creativity through constraint, obstruction and limitation.

1. The Budget is Sacred

All productions must be achievable within the budget provided by the active subscriber base (initially capped at $90,000 during this beta phase). No exceptions. This is our social contract with our community.

2. Cast Size is Capped

No production may employ more than 5 actors on stage at any time. Doubling roles is encouraged.

3. Design Must Be Minimal

Sets, costumes, lighting, and sound must adhere to a philosophy of radical simplicity:

All scenic elements must be handmade, repurposed, recycled or minimal.

Costumes must be sourced from existing materials, thrifted, or actor-owned wherever possible.

The lighting and sound elements should be minimal.

4. No Technology for Technology’s Sake

Projections, video, elaborate technical effects and automation are prohibited unless absolutely essential to the storytelling and achievable within budget. The human body, voice and imagination are prioritized.

5. The Play Must Be Location-Agnostic

All plays must be venue-flexible. Submissions must not rely on site-specific demands or elaborate location requirements.

6. Time Limits

Total running time, including intermission, must not exceed 120 minutes.

7. Accessible for All

Scripts and concepts must not create undue barriers for audience accessibility (physical, sensory, etc…). Productions will be designed with inclusion and simplicity in mind.

8. Playwright Participation

Playwrights must be open to collaboration and adaptation to meet the needs of the production model. Final scripts must align with the financial, artistic and logistical framework.

9. Originality and Rights

Submissions must be original, new works. No remounting of existing plays. However, adaptations are permitted but complicated licensing arrangements will not be considered in this phase.

10. Art Over Commerce

The work comes first. Ego, spectacle, profit and hierarchy come not at all.

11. Enforcement and Flexibility:

These rules will be part of the submission guidelines and author agreements that all paid subscribers sign onto upon subscription.

Exceptions may be considered only when costs remain neutral or are offset by other reductions.

Final discretion lies with Theater No More's beta-phase producing team (to be decided) in consultation with the subscriber community.

Thank you for reading. There is much to be evolved here before initiation, but I think it’s better than the rat-race we have now.

I love thinking outside many current models! This kind of ideation is much needed.

A couple of thoughts/ questions

-are the productions back to back so that rental costs may be maximized—including insurance costs for the venue?

-what if an already existing company would like to invite TNM to co-pro—for instance, a place like Jack in Bklyn which has liberation ethos. Because where you rent the venue also attracts different members of the community. Who’s comfortable traveling to what neighborhood, how bad is the police presence, what are the public transport options?

-if subscribers skip a production are those tix made available to non-subscribers on a sliding scale?

-how do you prevent folks from trying to add enhancement money? Does enhancement for one show get divided equitably between all three shows?

-with runs of 16 perfs in a 2 week period are you looking at 8 show weeks?

-what makes this different from a fringe festival model—more runs, what else?

-your budget of 3k for 3 shows either means all the press happens at once for three shows or that it is 1k for each show. In NYC press reps that reach news outlets are often at least 5k+ (I’m not sure what clubbed thumb pays)

-who are these producers and how are they selected? How do these producers work with each other? Are you thinking one producer per show?

-books feel nice in your hand and on a shelf, but if you don’t print them, you do a downloadable version, that’s good for the environment and slashes pub costs significantly.

-what if we didn’t limit cast size, but said, here’s your equity approved budget for actors? What if we paid actors more than the minimum.

-You could look at National Queer Theater’s model during June at their Criminal Queerness Festival. They produced 3 plays for runs of five perfs each—I know we’re talking about 16 perfs per show, so that is a difference.

To be continued

Very cool concept -- it's very broadway-adjacent. But there’s a red flag to factor in here: the moment you tell people their $180 will come back, you’re not just selling “memberships,” you’re selling an investment security, and that drags the SEC into the stich. It gets more complicated fast. I'm not an expert on any of this but with an MBA I know you’ll need the right corp entity, a brief SEC “offering” filed through a crowdfunding portal (eg, Wefunder), and a system for investor records + annual updates to the SEC. And you’ll prob want to factor in about 7-8 % of whatever you raise for the portal’s fee and maybe another few grand for a CPA, not sure if that’s needed. I think these portals handle all the K-1s or 1099s so you’re not mailing tax forms to 500 people. Also returning investor’s original $180 should be tax free, but if it goes above that they pay the tax. So I rec you book a consult with a securities-savvy lawyer or a broadway producer with deep domain knowledge of the investment security side and then rehash out the budget and operational plan. All this would be to protect yourself from violating SEC regulations. It's totally doable. You just have to wade thru a bit more shit!